SavvyMoney - Credit Score and Report

SavvyMoney Credit Score

SavvyMoney Credit Score

Help stop identity theft, monitor your credit score.... and more!

Take control of your credit score!

- Help stop identity theft through free credit monitoring. Watch for things like new accounts being opened, changes in address or anything that looks "off" on your credit report.

- Monitor your credit with important alerts.

- Understand what influences your score and how to improve it with personalized tips.

- Do this all with no impact to your score!

How to get started

- Log into digital banking

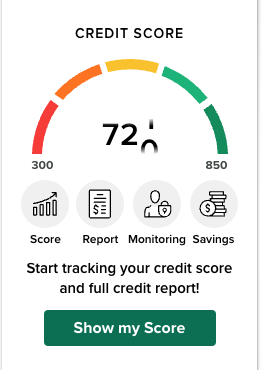

- Find the "CREDIT SCORE" widget on the digital banking landing page

- Click "Show my Score"

SavvyMoney FAQs

What is SavvyMoney?

SavvyMoney is a comprehensive Credit Score program that helps you stay on top of your credit. You get your latest credit score and report, an understanding of key factors that impact the score, and more. With this program, you will gain a better understanding of your credit.

Credit Score also monitors your credit report daily and informs you through digital banking and by email if there are any big changes detected such as: a new account being opened, change in address or employment, a delinquency has been reported or an inquiry has been made. Monitoring helps users keep an eye out for identity theft.

Credit Report provides you the information you would find on your credit file including a list of current or previous loans, accounts and credit inquiries. You will also be able to see details on your payment history, credit utilization and public records that show up on your account. Like Credit Score, when you check your credit report, there will be no impact to your score.

Why do credit scores differ?

There are three major credit-reporting bureaus—Equifax, Experian and Transunion—and two scoring models—FICO or VantageScore—that determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 factors of a credit report may be considered when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical but should directionally be similar.

The Bank of Washington uses separate processes than SavvyMoney for making loan decisions. Your personalized credit score presented in SavvyMoney is for educational purposes, intended to help you understand the factors that affect your credit score. This score may be different than a credit report we run at a specific time for a loan product.

How do I see my credit score in digital banking?

The ability to see your credit score through SavvyMoney is built into our digital banking and is one click away!

On a desktop computer:

- Log into digital banking.

- Click on the green "Show my Score" button on the credit score widget on the right side of the landing page screen.

- Log into our digital banking app.

- Scroll to the bottom of the landing page.

- Click on the green "Show my Score" button of the credit score widget.

Not a digital banking user? Sign up now.

What if the information provided by SavvyMoney Credit Score appears to be wrong or inaccurate?

The SavvyMoney Credit Score makes its best effort to show you the most relevant information from your credit report. If you think that some of the information is wrong or inaccurate, we encourage you to take advantage of obtaining free credit reports from www.annualcreditreport.com, and then pursuing with each bureau individually. Each bureau has its own process for correcting inaccurate information but every user can “File a Dispute” by clicking on the “Dispute” link within their SavvyMoney Credit Report. However, The Federal Trade Commission website offers step-by-step instructions on how to contact the bureaus and correct errors.